Blog

Great things in business are never done by one person. They’re done by a team of people. We have that dynamic group of peoples

-

How Buyers Assess Risk Before They Write You a Check

When considering the purchase of a business, risk assessment is a critical step that cannot be overstated. We guide you through a detailed due diligence.

-

Business Exit Readiness Assessment — Are You Actually Ready to Sell?

Most business owners don't wake up one morning and decide to sell. They think about it first. According to the Exit Planning Institute, a business.

-

The Financial Cleanup You Must Do Before Selling Your Business

When preparing to sell your business, having accurate and up-to-date financial records is crucial. Your Business Broker will rely on your company's tax returns and.

-

How to Build a Data Room That Impresses Serious Buyers

Creating a virtual data room that impresses serious buyers is crucial when selling your business. We guide you through the process of building a secure.

-

Sell-Side Quality of Earnings — Why Buyers Care So Much

Selling a business can be a complex and overwhelming process. A Quality of Earnings study serves as a financial roadmap, presenting the earnings and financial.

-

How to Improve Your Business Valuation Before You Sell

Selling your business is a significant decision, and you want to ensure you get the best possible valuation. To achieve this, it's crucial to understand.

-

EBITDA Multiples for Small Businesses — What’s Realistic?

Understanding the value of your small business is crucial when considering a sale or investment. One key metric used in valuation is EBITDA multiples, which.

-

How to Sell a Business in New York (Step-by-Step)

Selling a business is a complex process that requires careful planning and execution. In New York, where the business landscape is highly competitive, preparing your.

-

New York Founder Liquidity Event — What It Really Looks Like

For startup founders in New York, a liquidity event is a pivotal moment. It represents a significant milestone, often the culmination of years of hard.

-

How Confidential Business Sales Work in New York

When selling a business discreetly in New York, confidentiality is paramount to protect sensitive information and maintain relationships with employees, customers, and suppliers. We understand.

-

Selling a Business in Manhattan — What Actually Moves the Needle

Understanding the Manhattan business landscape is crucial for a successful sale. The area is known for its fast-paced and competitive market, making it essential to.

-

Who Are the Most Active Private Equity Buyers in New York?

New York City's status as a global financial hub makes it an ideal environment for investment firms to thrive. The city's access to capital, talent.

-

Sell My Business in New York — What Owners Should Expect

Selling a business in New York can be a complex and daunting task. Understanding what to expect is crucial for a successful transaction. According to.

-

How Confidential Business Sales Work in Florida

When you decide to sell your business, maintaining confidentiality is crucial. Many business owners worry that if employees, customers, or competitors find out about the.

-

Florida Lower Middle Market M&A: Where Deals Are Happening

The Florida lower middle market M&A landscape is vibrant, with numerous deals happening across various industries. As experts in the field, we have observed a.

-

How to Get Your Business Ready for Acquisition in 6 Steps

Preparing your business for sale is a complex process that requires careful planning and strategic decision-making. According to industry experts, having a clear understanding of.

-

Selling a Business in Tampa — What Buyers Are Paying Right Now

Tampa's business market is experiencing a surge in demand, with record-breaking transaction volumes and an influx of buyers competing for quality businesses. Private equity groups,.

-

Florida Business Exit Planning — What Smart Owners Do Early

Deciding when to exit your business is a pivotal moment in your entrepreneurial journey. Whether driven by retirement goals or changing market conditions, the timing.

-

What Actually Affects Your Business Valuation in a Sale?

Understanding business valuation is crucial for entrepreneurs and business owners looking to sell their companies. Many have an unrealistic idea of their company's worth, leading.

-

Direct-to-Owner Acquisition: How Buyers Approach You First

We specialize in curated, founder-led businesses exclusively for buyers, cutting through the noise in deal flow. By adopting a direct-to-owner acquisition strategy, buyers can source.

-

Selling a Business in Westchester — Buyer Appetite Explained

When it comes to selling a business in Westchester, understanding the local market and buyer appetite is crucial. We have found that buyers in regions.

-

Middle Market Deal Sourcing — Where the Best Opportunities Hide

As private equity professionals or family office principals, navigating the complex world of middle market investment opportunities requires a deep understanding of the strategies and.

-

How Private Equity Finds ‘Hidden Sellers’ Like You

Private equity firms have honed their skills in identifying hidden sellers, and we're here to share insights into their strategies. By analyzing their due diligence.

-

How to Value a Private Business for Sale (Owner’s Guide)

Selling a privately held business is a significant milestone in an owner's journey. Whether you're planning to retire, pursue new ventures, or capitalize on the.

-

New York Lower Middle Market M&A — Deal Trends You Should Know

As we close out 2025, the mergers and acquisitions market, particularly in the $5–$100M deal range, is showing signs of recovery. Improved financing conditions and.

-

How Buyers Use Cold Outreach to Acquire Businesses

Acquiring businesses can be a complex and challenging process, but with the right strategies, it can be a game-changer for buyers. Cold outreach has emerged.

-

NYC Founder Exit Planning: How to Leave on Your Terms

For entrepreneurs, a well-planned exit strategy is crucial for protecting wealth, strengthening the business, and ensuring a smooth transition.We understand that planning your exit can.

-

Deal Origination in the Lower Middle Market — How Buyers Hunt

In the competitive world of mergers and acquisitions, identifying and securing the right opportunities can make or break your pipeline. We will explore the world.

-

Selling a Small Business in NYC: A No-Nonsense Guide

Navigating the Complexities of Business Sales in New York CitySelling a business in New York City can be a daunting task, given the city's fast-paced.

-

How Private Equity Sources Small Businesses No One Else Sees

At our firm, we specialize in identifying hidden gems in the private market, uncovering small businesses that others may overlook. By leveraging our extensive network.

-

How Proprietary Deal Flow Gives Buyers an Edge — and What That Means for You

In today's competitive private equity landscape, having access to exclusive acquisition opportunities can be a game-changer for buyers. We help you understand what gives buyers.

-

How Buyers Really Find Off-Market Businesses Like Yours

Buying an existing business is significantly less risky than starting from scratch. An established firm comes with a recognized market presence, a loyal customer base,.

-

Florida Founder Exit Strategy — How to Plan Your Departure

Planning your exit strategy is crucial for securing your business's future. According to Don Tebbe, "An exit strategy can guide the transition process and help.

-

Search Fund Earnouts — Fair Deal or Hidden Trap?

When considering the sale of your business, understanding the intricacies of earnout agreement terms is crucial. Earnouts can be a double-edged sword, offering both benefits.

-

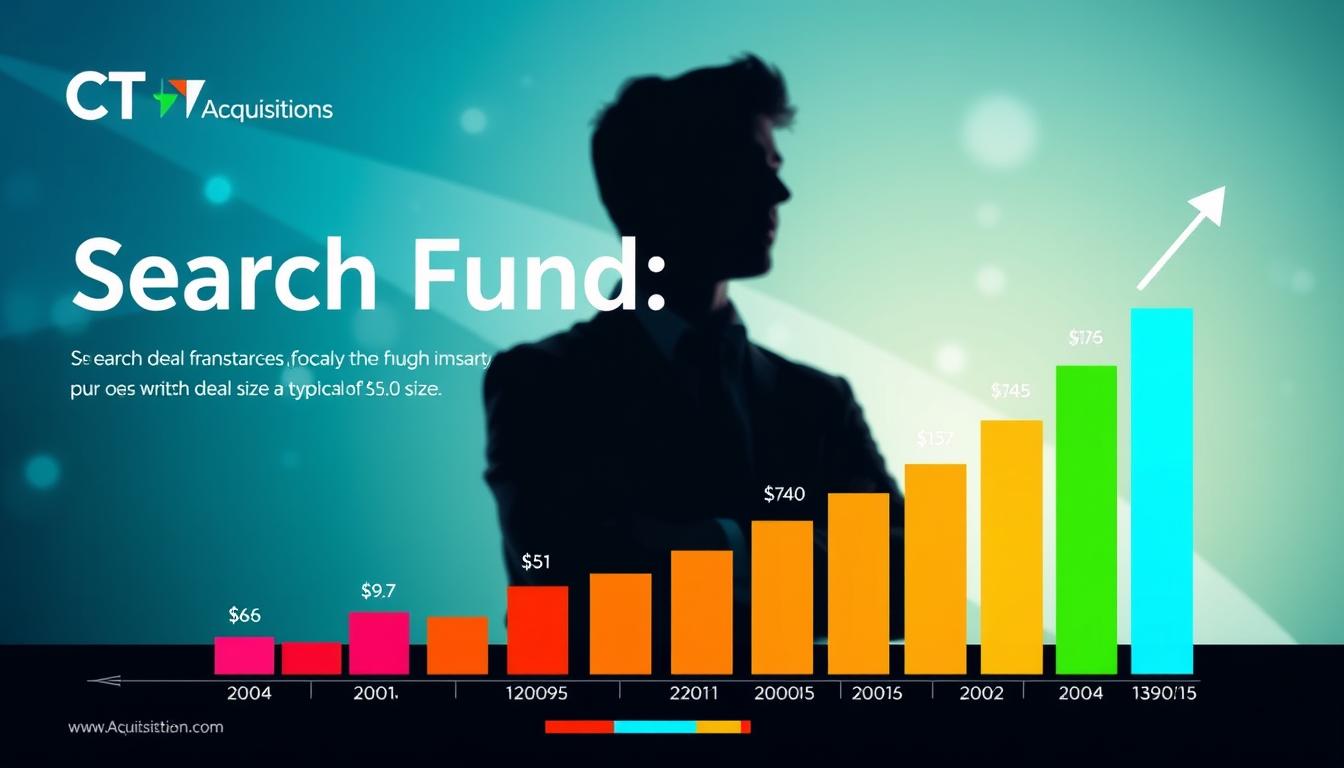

How Search Funds Finance Acquisitions (and What Sellers Should Know)

Entrepreneurs often prefer acquiring and operating an existing business to building one from scratch. Search funds are a two-phase vehicle designed specifically for these entrepreneurs.We.

-

Who Are the Most Active Private Equity Buyers in Florida?

Tampa's central location in the sunshine state has made it a hub for corporate relocation, fostering a business-friendly environment that attracts substantial capital deployment. Private.

-

Search Fund vs Private Equity — Which Buyer Treats Sellers Better?

When business owners and investors consider their options, the comparison between a search fund and private equity isn't just academic; it's a decision that shapes.

-

What Search Funds Look for in Acquisition Targets

We specialize in guiding entrepreneurs and private equity professionals through the process of acquiring businesses using search funds. These investment vehicles enable entrepreneurs to raise.

-

How to Sell Your Business in Miami (Without Getting Burned)

Selling your business in Miami can be a daunting task, especially when burnout is a factor. At Unbroker, we understand the complexities of this situation.

-

What Is a Search Fund Buyer — and Should You Trust Them?

As a private equity professional or business owner, understanding the concept of search fund buyers is crucial for making informed decisions about your business.Search funds.

-

How to Sell a Family Business in Florida Without Chaos

Selling a family-owned business can be a complex and emotionally charged process, especially when it comes to navigating the intricacies of the Florida market. According.

-

Sell My Business in Florida — What Owners Need to Know First

Selling your business is a significant decision that requires careful planning and a thorough understanding of the current market trends. With the sunsetting of favorable.

-

Selling a Small Business in Florida: A Practical Guide

For owners of small to mid-market companies in Florida, selling a business valued under $20 million is a significant decision that requires careful planning and.

-

Why Some Buyers Go Directly to Founders Instead of Brokers

When acquiring a business, some buyers prefer to bypass brokers and connect directly with founders. This approach can be more efficient and cost-effective, allowing buyers.

-

How Buyers Build Proprietary Acquisition Pipelines

We help buyers construct a unique lead generation system, directly sourcing business acquisition opportunities from owners and minimizing competition.Proprietary deal flow is crucial for efficient,.

-

Inside the Search Fund Acquisition Process (From a Seller’s Perspective)

As a seller considering the sale of your business, understanding the search fund acquisition process is crucial. This process involves several key steps, including identifying.

-

What It’s Like to Sell Your Business to a Search Fund

Selling to a search fund is becoming an increasingly popular option for business owners looking to exit their companies. According to the 2024 Search Fund.

-

Why Relationship-Based Deal Sourcing Leads to Better Outcomes for Sellers

We believe that strategic partnerships are key to successful deal making. By focusing on collaborative sourcing, we help sellers achieve better outcomes.Strategic sourcing is a.

-

Why Off-Market Deals Often Get Better Prices

We have found that off-market deals have become highly sought after because they provide access to unique opportunities, less competition, and more control over the.

-

How Buyers Evaluate Private Companies Before Making an Offer

Evaluating private companies poses a unique challenge due to the lack of publicly available financial information. Unlike public companies, private companies keep their financials confidential,.

-

7 Signs Your Business Is Actually Ready to Sell

Deciding when to exit a business is a challenging and personal decision. For many entrepreneurs, the focus is on growth and survival rather than the.

-

How Buyers Find Private Business Owners to Acquire

Exiting a business is a significant milestone in an entrepreneur's journey. The outcome of that exit, financially, personally, and professionally, depends heavily on identifying the.

-

Why Buyers Love Founder-Led Businesses (and How to Leverage That)

The rise of founder-led enterprises is transforming the eCommerce landscape. Consumers are no longer just buying products; they're investing in people, stories, and missions. This.

-

How to Sell Your Business Without Disrupting Day-to-Day Operations

Selling your business is a complex and emotionally challenging process. As a founder, you've invested significant time and effort into building your company, and the.

-

The Real Exit Options Every Business Owner Should Know

As entrepreneurs, we often focus on making our business successful for as long as possible. However, this focus can sometimes deprive us of the motivation.

-

How Founders Can Transition Out Without Crashing the Business

Transitioning out as a founder can be a daunting task. According to Anastasia Koroleva, a renowned expert who has studied post-exit founders for 13 years,.

-

Typical Search Fund Deal Sizes — Are You in Their Range?

Understanding the dynamics of search fund acquisition is crucial for entrepreneurs and investors navigating the lower-middle-market landscape. According to the 2024 Stanford GSB Search Fund.

-

The Pros and Cons of Selling to a Search Fund (No Sugarcoating)

Since its inception in 1984, the search fund model has gained popularity, according to the Stanford Graduate School of Business. Entrepreneurs and investors alike are.

-

How Independent Sponsors Structure Deals That Actually Close

Independent sponsors, also known as fundless sponsors, have become a significant force in middle-market private equity. They raise equity and debt on a deal-by-deal basis,.

-

Search Fund Deal Structures Explained for Sellers

When selling your business, understanding the deal structure is crucial to ensuring you get the best outcome. Search funds offer a unique opportunity for sellers,.

-

What Makes a Company Truly Attractive to Buyers?

Building a business that's attractive to buyers is a powerful way to pursue a successful future and a sign of its value. We help you.

-

How to Sell Your Business When You Have No Clear Successor

Succession planning is a critical aspect of business ownership, yet many owners fail to plan for the future, potentially leading to chaos. When there's no.

-

Selling to an Independent Sponsor — What Most Owners Don’t Expect

When business owners decide to sell, they often encounter various types of buyers, each with unique characteristics and expectations. Independent sponsors are becoming increasingly popular.

-

Who Actually Sells to Search Funds? Real Seller Profiles

Search funds are gaining momentum in Canada, driven by succession needs among small to medium-sized business owners and increasing investor appetite. As a result, understanding.

-

How Service Businesses Get Acquired by Private Equity

Private equity firms have been increasingly interested in acquiring service businesses, driven by their potential for growth and returns. As a service business owner, understanding.

-

How Independent Sponsors Buy Businesses (and What It Means for You)

As a business owner, understanding the role of independent sponsors in the M&A landscape can be crucial for making informed decisions about your company's future..

-

Selling a Business with Recurring Revenue: What You Need to Know

When it comes to maximizing the value of your business, having a recurring revenue model can be a significant advantage. Businesses with predictable cash flow,.

-

Should You Sell to a Search Fund? Pros, Cons, and Reality

Owning and managing a business can be an exciting opportunity, but finding the right path to success isn’t always straightforward. Search funds offer a proven.

-

Sell-Side Due Diligence: What Buyers Will Dig Into First

When you decide to sell your business, one of the most crucial steps is preparing for buyer scrutiny. Potential buyers will dig deep into every.

-

How to Sell Your Business and Stay Involved Without Regretting It

Selling your company is a significant decision that involves more than just financial considerations. It's about ensuring a smooth transition that aligns with your goals.Experts.

-

How to Negotiate with Private Equity Without Getting Played

Negotiating with private equity firms can feel like entering a high-stakes chess match where preparation and strategy determine success. To navigate this complex process effectively,.

-

Founder Liquidity Events Explained in Plain English

We understand that navigating the complexities of liquidity events can be challenging for founders. A liquidity event is a transaction that allows investors and founders.

-

Selling Your Business in Your 40s or 50s — What to Consider First

As you approach midlife, the decision to exit your business can be both exciting and daunting. At this stage, you've likely built a significant asset,.

-

Founder Burnout: When Selling Your Business Might Be the Right Move

Running a business can be all-consuming, often leading to emotional, mental, and physical exhaustion. We understand that founder burnout isn't just about working too much;.

-

Is Your Business Actually Sellable? A Hard-Truth Checklist for Owners

Many founders remain uncertain about the sellability of their business. Predictable profit, minimal reliance on the owner, and a compelling growth story are key indicators.

-

How Private Equity Really Prices Small Businesses

Understanding the valuation of small businesses is crucial for business owners considering their options. Private equity financing is a general term for funding for small,.

-

Private Equity vs Strategic Buyer — Which Is Better for You?

When you've reached the point of selling your business, after years of hard work, there's one last major decision to make: who to sell to..

-

How Confidential Business Sales Work Without Spooking Employees or Clients

Selling a business confidentially is a delicate matter that requires careful handling to avoid disrupting employee and client relationships. We guide founders through discreet transactions,.

-

How to Maximize Your Business Sale Price Before You Go to Market

As the M&A market continues to evolve, sellers must adapt their strategies to maximize their business sale price. With buyers scrutinizing companies more than ever,.

-

The Costly Mistakes Owners Make When Selling Their Business

Selling a business is a monumental decision that can be fraught with costly pitfalls. Many entrepreneurs underestimate the emotional and financial aspects of exiting a.

-

How to Avoid Getting Lowballed When Selling Your Business

Selling a business can be a complex and challenging process. To maximize profits, it's crucial to understand the market value of your business and prepare.

-

How to Sell Your Business Without a Broker (Step-by-Step Playbook)

Selling your company can be a straightforward process if you have the right guidance. Understanding your 'why' is crucial as it guides every decision you.

-

The Exact Checklist to Prepare Your Company for Sale in 90 Days

To sell your business successfully, you need to be prepared. Our 90-day checklist guides you through essential steps, from cleaning up your finances to optimizing.

-

Exactly What Buyers Look for Before Making an Offer

When considering an acquisition, serious buyers meticulously evaluate a business to determine its potential for growth and profitability. Understanding acquisition criteria is crucial for business.

-

What Really Happens When You Sell a Founder-Led Business

When an entrepreneur decides to sell their company, it's not just a financial transaction; it's a significant life event. The process of selling a founder-led.

-

Why So Many Business Owners Want to Sell — But Never Do

Many entrepreneurs face significant challenges when deciding to sell their business. Despite their desire to move on, various sales roadblocks hinder the process. According to.

-

Seller Financing in Business Sales — Risks, Rewards, and Real Examples

When acquiring a business, traditional financing isn't always an option. This is where seller financing comes into play, offering a viable alternative for buyers and.

-

How to Run a Competitive Sale Process That Drives Up Value

Maximizing the value of your business requires a strategic sale process. A well-executed sale process is crucial for attracting potential buyers and securing the best.

-

Earnouts Explained: How They Work and When They Backfire

When selling a business, the terms of the sale can be complex and nuanced. An earnout agreement is a contractual provision that allows the seller.

-

How Private Equity Evaluates Small Businesses Behind Closed Doors

When private equity firms consider investing in small businesses, they conduct a thorough assessment to determine the potential for growth and returns. This evaluation process.

-

How to Successfully Sell a Family-Owned Business Without Destroying Relationships

Selling a family-owned business can be a complex and emotionally charged process. Conflicts often arise from succession planning, roles within the company, and long-term direction,.

-

Should You Sell Your Lifestyle Business? What Buyers Really Think

Deciding to sell your business can be a complex and daunting task. According to Drew Sanocki, it's essential to consider various factors before making a.

-

How to Run a Sale Process That Attracts Multiple Serious Offers

Generating interest from multiple buyers is crucial in maximizing valuation and improving deal terms in an M&A process. When you attract several serious offers, you.

-

Partial Sale vs Full Sale — Which Exit Actually Makes More Sense?

When considering the sale of a business, owners are often faced with a critical decision: whether to opt for a partial sale or a full.

-

How Off-Market Business Sales Happen — and Why They Get Better Deals

When it comes to acquiring a business, many buyers overlook the benefits of confidential business sales. We specialize in connecting buyers with off-market business opportunities.

-

How Discreet Business Sales Really Work (and How to Protect Your Reputation)

Selling a business is a significant and sensitive decision for any owner. Whether driven by retirement, new opportunities, or strategic pivots, the confidential company acquisition.

-

How to Sell a Privately Held Company Without Leaving Money on the Table

Selling a business is a significant milestone, and maximizing its value is crucial. At BySTS Capital, we understand the intricacies involved in selling a business.

-

Exit Planning for Private Business Owners — What You Should Be Doing Now

As a business owner, you've dedicated yourself to building a successful company, but have you considered what will happen when you're ready to step away?.

-

When Is the Right Time to Sell Your Business? The 7 Signals You Can’t Ignore

Selling your business is a significant decision, marking both an exit and a new chapter. But how do you know it's the right moment to.

-

How Long It Really Takes to Sell a Business (and Why Most Owners Misjudge It)

Most business owners don't actually know what their business is worth, and this disconnect can cost them whether they're thinking about selling or not. Selling.

-

A Buyer’s Guide to Business Acquisition Success

We cut through deal noise to help you find founder-led opportunities that match a clear thesis. This guide is pragmatic. It favors repeatable execution over.

-

What Is Private Equity and How Does It Work?

Private equity is long-term ownership in companies that aren’t traded on public exchanges. It’s about control, governance, and active value creation — not short-term stock.

-

Private Lenders: How to Secure Flexible Funding

We cut through the noise. This guide explains how borrowing from individuals or businesses can unlock capital when banks stall.Fast execution, flexible terms, clear math..

-

A Complete Guide to Mergers and Acquisitions

We cut through the noise. This guide explains what mergers and acquisitions cover in plain terms so you can make fast, clear decisions.At its core,.

-

Top Private Equity Firms You Should Know

We cut through the noise and give you a pragmatic overview of the leading names shaping U.S. dealmaking. This is a practical list. Not hype..

-

Acquisition Strategy That Drives Growth

We define an acquisition strategy as a practical plan that turns intent into repeatable deal execution in the U.S. lower-middle-market. It is a written reference.

-

Investment Banking vs Private Equity Explained Simply

Quick clarity. We cut through jargon to show the practical difference between two major paths in the finance industry.In plain terms: one side runs transactions.

-

The Smartest Ways to Raise Capital for Your Business

We cut through the noise. Today there are more paths to secure funds than ever. Macro trends and diverse funding sources mean savvy operators can.

-

How Private Equity Firms Source the Best Deals

We cut through the noise. Today’s market rewards timely access, not mass outreach. Modern sourcing blends relationships with focused technology to surface proprietary opportunities before.

-

Equity Capital Markets: How Companies Raise Millions

We open this ultimate guide with a clear promise: no fluff, just what moves outcomes. The equity capital market sits between banking and trading. It.

-

Deal Sourcing Strategies Used by Private Equity Pros

Deal sourcing is the systematic search for investment opportunities that fit a buyer’s thesis and criteria.It’s the front end of the investment process. Get this.

-

How to Find the Right Investors for Your Business

We cut through noise. Funders do more than provide capital. They bring expertise, networks, and credibility that speed execution.Our approach treats fundraising as a curated.

-

Buy-Side Advisory: How to Protect Your Interests

We protect buyers when deals get competitive and timelines compress. Our role is simple: reduce bad targets, tighten diligence, secure better terms, and drive cleaner.

-

Private Equity Investment: How It Really Works

We cut through the noise and explain how capital flows from commitment to exit in today’s U.S. market. Private equity matters because roughly 86% of.

-

Top M&A Firms for Mid-Market Deals

We map the advisors you should know when mid-market outcomes matter. This list is practical. It is not a prestige ranking. It points to teams.

-

Sell-Side Advisory: Maximize Your Exit Value

We help founders and middle-market owners get more from a company sale. Our advisor team tightens the story, improves diligence readiness, and controls process risk..

-

M&A Advisory Services: What You Need to Know

We help buyers move from strategy to close without guesswork. Our m&a advisory approach bundles deal strategy, disciplined valuation, and integration planning so you capture.

-

Strategic Acquisitions That Transform Businesses

We cut through deal noise. Buying the right company can grow scale faster than organic moves. It can diversify risk and create long-term resilience in.

-

Raise Capital Fast: Proven Strategies for 2025

We write for executives who need speed with structure. As 2025 wraps and teams plan for 2026, quick access to funds matters. But structure matters.

-

How to Find Truly Passive Real Estate Investments

Discover how to find passive real estate investments with our expert guide. Learn the strategies to identify lucrative opportunities that generate passive income.

-

Tax Strategies Real Estate Investors Use to Keep More Profit

Discover expert tax strategies for real estate investors to minimize liability and maximize profits. Learn more in our Ultimate Guide.

-

Real Estate Exit Strategies: Plan Your Win Before You Buy

Get ahead with our Ultimate Guide to real estate investment exit strategies. Curated M&A expertise helps you make informed investment decisions.

-

Investment Property Evaluation: What Actually Drives Returns

Learn how to evaluate investment property effectively with our expert guide. Discover key factors that drive returns on investment.

-

Private Investors for Real Estate: How to Attract Capital

Learn how to attract private investors for real estate deals with our expert guide. Discover strategies to secure capital for your next project.

-

Real Estate Due Diligence Checklist for Serious Buyers

Conduct thorough real estate investment due diligence with our Ultimate Guide. We provide a comprehensive checklist to ensure informed investment decisions.

-

Real Estate Deal Analysis: The Framework Smart Buyers Use

"Master real estate deal analysis with our expert framework. Learn how to evaluate properties and make informed investment decisions."

-

How to Find Real Estate Investors for Your Next Deal

Discover how to find real estate investors for your next deal. Learn effective strategies to attract investors and grow your business.

-

Real Estate Market Trends That Signal Opportunity

Explore the future of investments with our real estate market trends analysis. We curate vetted opportunities for discerning buyers.

-

How to Analyze Real Estate Deals Like an Institutional Investor

Discover how to analyze real estate deals effectively. Our how-to guide helps you make informed investment decisions.

-

Best Cities for Real Estate Investors Looking for Cash Flow

Find the best cities for real estate investors looking for cash flow in our comprehensive listicle. Expert insights for informed investment decisions.

-

Commercial Real Estate Investing: What Pros Focus On

Learn the essentials of commercial real estate investing with our beginner's guide. Discover what professionals focus on to succeed.

-

Real Estate Investment Tips From Top Dealmakers

Get expert real estate investment tips from top dealmakers. Learn how to make smart investments with our curated guide.

-

Real Estate Investment Strategies for Serious Performance

Discover effective real estate investment strategies for serious performance. Explore our curated listicle for insights and opportunities.

-

REITs vs Direct Ownership: Which Builds More Wealth?

Discover the benefits of real estate investment trusts (REITs) vs direct ownership in our beginner's guide. Learn which builds more wealth.

-

Multifamily Investing Strategies for Passive Wealth

Discover expert multifamily investing strategies in our Ultimate Guide. Learn how to build passive wealth through smart real estate investments.

-

Best Markets to Invest In Right Now (2025 Edition)

Find out the best real estate markets to invest in right now. Our listicle highlights the most promising opportunities for real estate investors in 2025.

-

How to Finance Investment Property: Funding Options That Work

Learn how to finance investment property with our expert guide. Discover funding options that work for you and grow your portfolio effectively.

-

How to Invest in Real Estate With Confidence

Learn how to invest in real estate with confidence. Discover our expert guide to making informed investment decisions in today's market.

-

Real Estate Investing for Beginners: First Steps That Matter

Start your investment journey with our comprehensive guide to real estate investing for beginners. Learn the first steps that matter today.

-

Finding Off-Market Deals: Tactics Investors Swear By

Discover expert tactics for finding off market deals. Learn how to source motivated sellers and secure exclusive opportunities.

-

Investment Property for Sale: How Smart Buyers Source Deals

Browse our directory for investment property for sale. Expertly sourced deals for serious buyers. Start your search now.

-

What Is Off-Market Real Estate? A Beginner-Friendly Definition

Get a clear understanding of what is off market real estate and its advantages in the current market. Explore our comprehensive buyer's guide.

-

How to Find Off-Market Deals That Close Fast

Find out how to find off market deals quickly with our step-by-step guide. Eliminate deal flow noise and source vetted lower-middle-market opportunities.

-

Off-Market Commercial Real Estate: Where to Look (and How to Win)

Unlock off market commercial real estate deals with our curated Buyer's Guide. We provide the insights you need to succeed in a competitive landscape.

-

How to Find Off-Market Commercial Real Estate Before It Hits the Market

Get ahead in commercial real estate investing by learning how to find off market commercial real estate. Our step-by-step guide reveals expert strategies.

-

How to Find Off-Market Properties on Zillow (Yes, Really)

Learn how to find off market properties on Zillow. We provide a step-by-step guide to help you identify and acquire off-market deals.

-

How to Find Off-Market Multifamily Properties With Real ROI

Learn how to find off market multifamily properties with our step-by-step guide. Uncover hidden opportunities and boost your investment returns.

-

How to Buy Off-Market Property Without Brokers

Learn how to buy off market property without brokers. Discover curated off-market deals and expert guidance for private equity professionals and independent sponsors.

-

How to Find Off-Market Real Estate Deals Like a Pro

Learn how to find off market real estate deals like a pro. We share our curated strategies for identifying and securing off-market properties.

-

Off-Market Land Deals: The Hidden Opportunity

Unlock off market land opportunities with our step-by-step guide. We provide curated insights to help you navigate the US land market with confidence.

-

Off-Market Real Estate: Why the Best Deals Aren’t Listed

Discover the secrets to finding off market real estate deals with our expert guide. Learn how to access exclusive listings and stay ahead of the competition.

-

Where to Find Off-Market Properties That Cash-Flow

Learn where to find off market properties. We source motivated founder-led businesses exclusively for buyers, eliminating deal flow noise.

-

How to Find Off-Market Businesses for Sale

Learn how to find off market businesses for sale with our curated guide. We connect buyers with motivated sellers and exclusive M&A opportunities.

-

What “Off-Market” Really Means in Real Estate

Discover the truth about off-market real estate. Learn what does off market mean in real estate and how it impacts your investment decisions today.

-

Investment Thesis Examples Private Equity Firms Actually Use

Discover effective private equity investment thesis examples used by top firms. Our ultimate guide provides curated insights for informed investment decisions.

-

How to Find Off-Market Properties Before Anyone Else

Learn how to find off market properties with our step-by-step guide for private equity pros & sponsors seeking lower-middle-market deals.

-

Selling Your Business to Private Equity: A No-Nonsense Guide

Learn how to sell my business to private equity with our step-by-step guide. Discover the best strategies for a successful transaction.

-

Search Fund Deal Origination: Winning in Competitive Markets

Master search fund deal origination strategies with our comprehensive Ultimate Guide. Curated insights for private equity professionals and independent sponsors.

-

Private Equity Exit Strategies: How Investors Plan Returns

Discover effective private equity exit strategies in our Ultimate Guide. Learn how investors plan returns and maximize value

-

How to Get Acquired by Private Equity at the Best Valuation

Get acquired by private equity at the best valuation. Our how-to guide provides actionable tips and expert insights for founders and business owners.

-

Private Equity for Founders: What It Means to Sell to a PE Firm

Understand 'private equity for founders' and its implications. Our buyer's guide explains the process of selling to a private equity firm and what to expect.

-

How to Build a Scalable Deal Origination Pipeline

Discover how to build a deal origination pipeline efficiently. We provide thesis-aligned deal sourcing for private equity and independent sponsors.

-

Deal Structuring: Protecting Return While Aligning Interests

Master deal structuring with our expert guide. Learn how to protect returns and align interests in today's M&A landscape effectively.

-

Due Diligence Process: What Serious Buyers Look For

Navigate the due diligence process like a pro. Get our curated insights on what matters most to serious buyers in M&A deals.

-

Corporate Finance Deals: Smart Structures for Scale

We analyze corporate finance deals to identify smart structures for scale, helping you make informed investment decisions.

-

How to Source Deals That Fit Your Investment Thesis

Learn how to source private equity deals with our expert guide. Discover curated, founder-led opportunities that fit your investment thesis.

-

Deal Origination Best Practices Used by Elite Firms

Get insider knowledge on deal origination best practices. We share curated strategies to help you identify and secure top lower-middle-market acquisition opportunities.

-

Mid-Market M&A Origination: Where the Best Deals Live

Navigate mid-market M&A origination with confidence. Our how-to guide provides expert advice on finding top acquisition opportunities.

-

Buy-Side M&A Strategies That Beat Competitive Bidding

Discover expert buy-side M&A strategies to outmaneuver competitors. Our ultimate guide reveals curated approaches for successful acquisitions.

-

Growth Equity Investments: What Founders Need to Know

Discover the essentials of growth equity investments in our Ultimate Guide. Learn what founders need to know to navigate this investment landscape effectively.

-

Deal Origination Workflow: The Proven Process PE Firms Use

Learn the deal origination process steps to eliminate deal flow noise. Our founder-led, thesis-aligned approach helps you source motivated businesses.

-

What Is Deal Origination? A Buyer’s Guide

Understand what is deal origination and eliminate deal flow noise with our expert guide. We source exclusive, founder-led businesses for buyers like you.

-

Investment Banking Deal Flow vs. Buy-Side Origination — Key Differences

We break down investment banking deal flow vs. buy-side origination. Understand the nuances and make informed decisions with our expert analysis.

-

M&A Advisory Services: When You Need Them (and When You Don’t)

Get expert M&A advisory services for efficient lower-middle-market acquisitions. We source motivated, founder-led businesses exclusively for buyers.

-

What Makes a Private Equity Firm Win Founder Deals?

Discover what makes private equity firms successful in founder deals. Learn the key factors driving their wins in today's market.

-

Private Equity vs Venture Capital: Which Buyers Founders Prefer

Discover the differences between private equity vs venture capital and which buyers founders prefer. Learn how each investment type aligns with business goals.

-

Mergers and Acquisitions: How Deals Really Get Done

Discover the insider's guide to mergers and acquisitions. Learn how deals get done with our expert insights and curated strategies for successful transactions.

-

AI Deal Sourcing Tools: The Future of Buy-Side Intelligence

Find the leading AI deal sourcing tools for private equity pros & independent sponsors. Enhance deal flow with our curated selection.

-

Private Equity Deal Flow: How to Turn Conversations Into Closings

Transform your private equity deal flow with our comprehensive Ultimate Guide. Learn how to eliminate noise and focus on thesis-aligned, founder-led opportunities.

-

Private Equity Strategy: Why Industry Focus Wins

Maximize your private equity strategy with industry-focused insights. Explore our ultimate guide for actionable advice.

-

PE Investment Opportunities: Where Capital Is Moving Next

Unlock PE investment opportunities in the US with our curated Buyer's Guide. Find thesis-aligned, founder-led businesses for efficient acquisition.

-

Private Equity Investments: A Simple Breakdown for Owners & Investors

Get a clear understanding of private equity investments with our comprehensive Ultimate Guide. We break down the complexities for investors and owners.

-

Deal Origination Salaries: What Professionals Really Earn

Get the facts on deal origination salary. Our buyer's guide reveals what deal origination professionals earn.

-

How M&A Deal Origination Platforms Are Changing the Buy-Side Game

Discover top m&a deal origination platforms curating exclusive, founder-led lower-middle-market acquisitions for private equity and family offices.

-

Deal Sourcing: The Playbook for Proprietary Opportunities

Deal sourcing made efficient. Our Ultimate Guide reveals how to source motivated, founder-led businesses and bridge the expectation gap for successful acquisitions.

-

Private Equity Deal Sourcing: What Works in 2025

Discover the latest strategies for effective private equity deal sourcing in our Ultimate Guide. Learn how to identify and secure top opportunities in 2025.

-

How to Build Proprietary Deal Flow (Without a Huge Team)

Discover the secrets to proprietary deal sourcing with our ultimate guide. Learn how to build a robust deal flow without a huge team, curated just for you.

-

The Best Deal Origination Platforms for Serious Investors

Explore the best deal origination platforms to streamline your investment process. Our roundup highlights vetted options for private equity professionals and independent sponsors.

-

How Private Equity Wins With Smart Deal Origination

Unlock efficient deal origination private equity strategies with our expert Ultimate Guide. Learn to bridge expectation gaps through honest curation.

-

Top Deal Sourcing Tools for Finding Off-Market Opportunities

Discover top deal sourcing tools to find off-market opportunities. We curate the best resources for private equity professionals and independent sponsors to streamline their M&A search.

-

Deal Origination Services That Deliver Real Opportunities

Get access to curated deal origination services that eliminate deal flow noise, sourcing founder-led businesses for serious buyers like you.

-

M&A Deal Origination Strategies for Faster, Better Closes

Unlock efficient m&a deal origination with our comprehensive Ultimate Guide. Curated insights for private equity pros, family offices, and independent sponsors.

-

Deal Origination Explained: The Engine Behind Every Great Acquisition

Discover the power of deal origination in our Ultimate Guide. Learn how to source motivated founder-led businesses and streamline your acquisition process effectively.

-

Deal Origination Software That Helps You Close

Streamline your deal flow with our curated list of top deal origination software. Designed for private equity, family offices, and independent sponsors.

-

Online Deal Sourcing Platforms: Which Ones Actually Work

We evaluate online deal sourcing platforms to help you find the best deal flow for lower-middle-market acquisitions.

-

Private Equity Deal Origination: What Top Buyers Do Differently

Discover the secrets to successful private equity deal origination. Our ultimate guide reveals what top buyers do differently to secure lucrative deals.

-

M&A Deal Origination: How Top Firms Find Better Targets

Discover the secrets to successful deal origination M&A with our Ultimate Guide. Learn how top firms find better targets and stay ahead in the competitive M&A landscape.

-

M&A Deal Sourcing That Surfaces Hidden Sellers

Navigate the future of M&A deal sourcing with expert insights. Our Ultimate Guide provides curated strategies for lower-middle-market acquisitions.

-

Deal Flow Management: Systems That Scale Opportunity

Streamline deal flow management with our comprehensive Ultimate Guide. Designed for private equity professionals and independent sponsors seeking vetted opportunities.

-

Deal Origination Process: A Step-by-Step Guide for Investors

Master the deal origination process with our step-by-step guide. Discover how to identify and secure profitable investment opportunities.

-

Deal Origination Meaning: What It Is and Why It Matters

Understand deal origination meaning and its role in sourcing lower-middle-market acquisition opportunities. Get insights into the process and its importance.

-

Deal Origination Strategy: A Competitive Edge for Buyers

Cut through deal flow noise with a curated deal origination strategy. Our ultimate guide provides clarity on sourcing vetted lower-middle-market acquisition opportunities.

Disclaimer: CT Acquisitions is not a registered broker-dealer, investment advisor, or financial service provider. We act solely as a buy-side consultant and independent sponsor source. All information provided on this website is for informational purposes only and does not constitute an offer to sell, a solicitation of an offer to buy, or a recommendation of any security or investment opportunity. We do not provide legal, tax, or accounting advice. Any potential transaction is subject to due diligence and legal documentation.

© 2025 CT Acquisitions. All Rights Reserved.